We attract what we think we deserve. We accept what we believe we are worthy of. As Ashley Ford, the best-selling author of Somebody’s Daughter: A Memoir, said in her recent interview, “When you grow up in poverty, there’s nothing in your mind that says, Even though I can’t get these things, I’m still worthy of them. The protective approach you develop is to NOT want anything.”

Your thoughts, mindset, and attitude about money can significantly impact your financial situation. It all starts in your mind!

If you genuinely believe you deserve to live a wealthy and luxurious life, then your subconscious mind will work magic to help you manifest that reality. But the opposite is also true.

In this blog post, I will share six tips to help you build a better relationship with money. Let’s dive in!

1. Identify your relationship with money

Before you start thinking about money, you need to know your relationship with it. And just like everything else in life, your childhood influences your relationship with money, too.

Now, I want you to take your journal out and write and answer these questions with brutal honesty. So, grab a cozy spot, get out your journal, and answer these questions honestly. No sugar-coating allowed!

What are the first five words or phrases that come to mind when you think of money?

What’s your first memory of money?

What was your family’s financial situation when you were growing up?

What did your parents teach you about money?

Did you ever feel a financial burden at home growing up?

What’s your parents’ relationship with money? Did they agree or disagree over money issues?

How do you currently feel about your financial situation? Are you satisfied with your current financial situation?

Do you feel comfortable talking about money?

What is your biggest financial fear?

By answering these questions, you learn more about your thoughts and beliefs about money. Also, it helps to understand how your upbringing and the people around you in your childhood influenced how you handle your finances today.

2. It’s not about what you make, it’s about what you keep

Pay yourself first.

It simply means putting money into savings and investments before paying bills or spending on other things. By putting money aside every month into savings or investments, you create a safety net for yourself. When you know you’ve got a little cash to fall back on, you can feel more confident and relaxed. Who doesn’t want their peace of mind?

Overtime, paying yourself first allows you to grow your wealth over time. By investing your savings, you can use compound interest, potentially earning more money in the long run.

3) Create new and healthy spending habits

I am no stranger to girl math. I am guilty of buying a new outfit for every special event, no matter how much stuff you have in your closet already. Or, buying eight pillows for your bed when you only sleep with two. That was the old me. New Me is thoughtful about her spending. I am no longer spending $30 to avoid $15 shipping.

Ladies! Better money habits can automate your savings. Save before you spend most of your paycheck.

Another new habit I have been enjoying is a money date. It means getting together with your friends or your partner and popping a bottle of wine while you talk money. You can put on music or light candles while reviewing your budget and discussing taxes.

4) Look at money as a tool

If our goal is more money, we will never have enough. There is always “more” money to spend on “more” material things. We’ll never truly be satisfied with such a mindset.

What do you need to buy your dream home? Money. What do you need to quit your draining job and take a year off to travel the world? Money. What do you need to keep a roof over your head? Money.

All these things have one thing in common-money. When it comes down to it, money is a tool that can give you the life of your dreams. Don’t use it as the end goal but instead a tool to get your dream life.

5) Have a wealthy mindset

I have this amazing mentor who I look up to as the most successful person I know. He once shared with me a truly inspiring story from his youth where he saved up for months to go to a fancy five-star hotel for a meal and just sat there, watching people and wondering how they could afford such a lavish lifestyle.

And then he thought, if they can do it, so can I. He wasn’t born with a silver spoon in his mouth – his family had to share a room. But he had a go-getter mindset and knew he could achieve anything he desired.

From him, I learned that your attitude determines your success or failure. It’s as Henry Ford once said, “If you think you can, or you think you can’t, either way, you are right.”

6) Change the way you word things

Harness the power of money affirmations to transform your inner dialogue about money and wealth. Speak your riches into existence. The way we word things matters!

So, we must speak about our success, career, and money in a positive light. This means bringing awareness to how you word things.

Here are a few examples of how you can change your words-

“I’ll never be able to afford that.” —> “I am working on a plan to make this mine.”

“I never have enough money to buy what I want.” —–> “I have more than enough money to support my desired lifestyle.”

“I am always stressed about money.” —–> “I am free from any finance or money-related worries.”

…………………………………………………………………………

Is there anything we missed? How would you describe your relationship with money? I’d love to know in the comments 😀

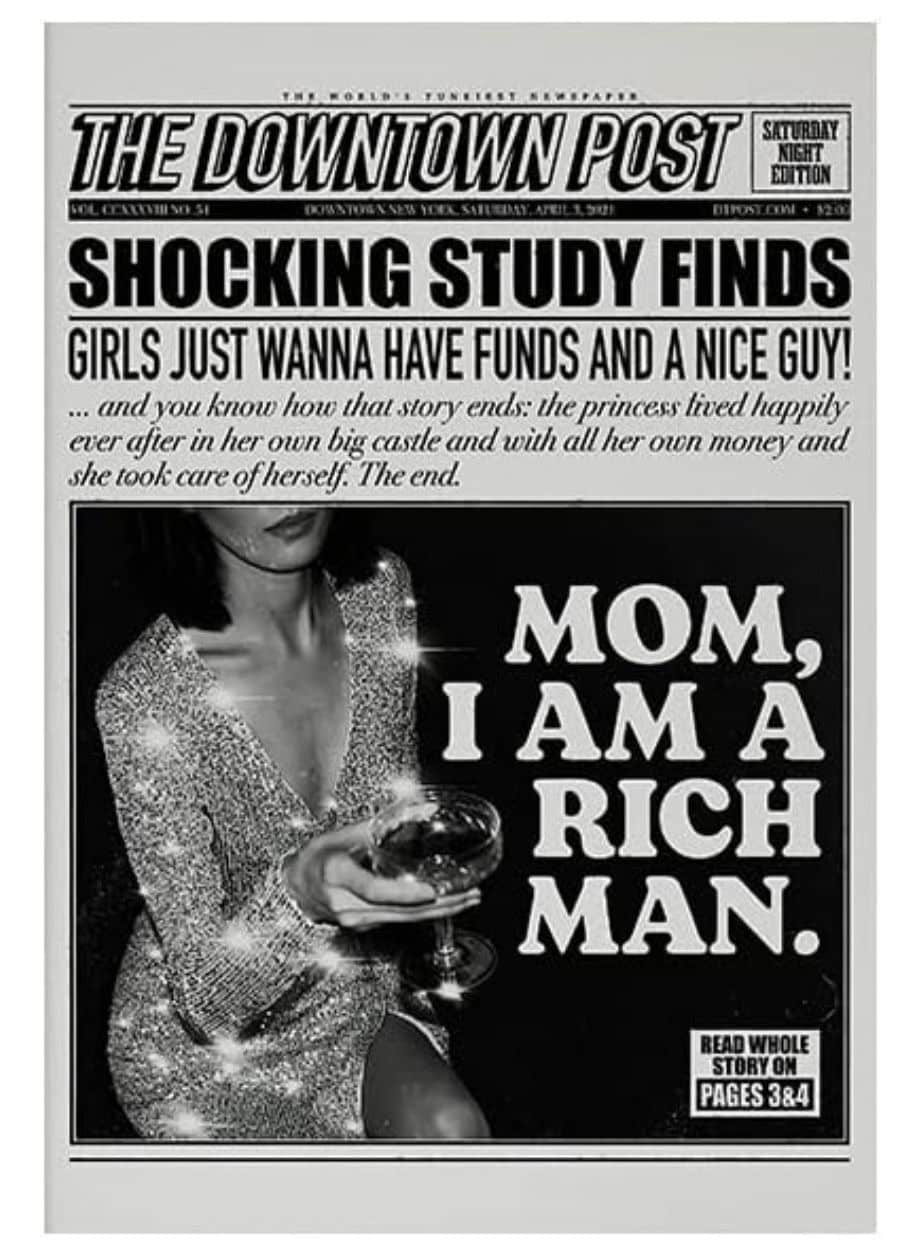

Featured Image Credits- Pinterest